87% of retail CFD accounts lose money with this provider. Your capital may be at risk.

No, IQ Option does not pay dividends when you trade CFDs of companies that pay dividends.

Table of contents

Do CFDs on IQ Option pay dividends

CFDs, contracts for difference, are a financial instrument that performances based on the underlying asset’s price movement.

When companies pay out dividends, many trading platforms make cash adjustments to open positions of that company.

These cash adjustments represent the dividend payout of the stock, meaning buy positions receive the dividend amount, and short positions pay the dividend amount.

IQ Option does not make cash adjustments to buy positions on the ex-dividend day.

When we asked the IQ Option support whether or not they pay dividends on CFD buy-positions, this is what they answered.

You cannot earn dividends on the stocks here. On our platform, you buy CFDs (contracts for difference), which only enables you to trade stocks, but not to own them, hence there are no dividends.

IQ Option Support Bot

It does, however, seem that IQ Option makes you pay the dividend in fees on the ex-dividend day if you’re shorting a stock on its ex-dividend day.

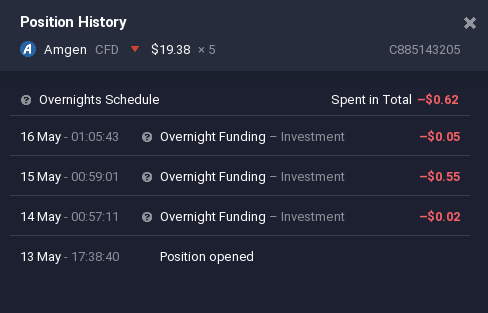

We opened a short-position on Amgen back in May and held the position through their ex-dividend day, the 15th of May.

On the ex-dividend day, we paid a much higher overnight fee than usual.

We asked support again to see whether or not you pay the dividend on the ex-dividend day if you short a stock. This is their answer.

Please note that the Company reserves the right to charge the Client a swap fee of 0.01% – 0.5% and in extreme circumstances might be up to 1.7% of the face value of the position for keeping a position open overnight.

Aleksandr, IQ Option Support

Because of this, we do not recommend keeping a short position open on a stock’s ex-dividend date, just to be safe.

As an alternative to paying dividends, many companies have started buying back their own stock, which in theory, gives the same return to shareholders.

If a company buys back its own stock, it’s usually reflected in the share price, in which case it will be reflected in the performance of CFD positions as well.

Disclaimer: Investerfy.com is not a financial advisor. All content on this site is for educational purposes only. Make sure you understand the risk associated with investing and trading.